Bankera Loans have been rebranded to SpectroCoin Loans. You can access our new service on the crypto loans page.

When considering the possibility of taking out a loan, it is crucial to analyze and understand the main advantages and risks. To make this process easier, we have decided to release a blog post explaining one of the principal concepts of lending that would help you understand the Bankera Loans service better and guide you when taking a loan — the Loan-to-Value ratio.

What is LTV?

LTV — meaning the Loan-to-Value ratio, is an assessment of loan risk, expressed as a percentage. It represents the relationship between the size of the loan and the value of the assets served as collateral.

If the value of the loan is close to the value of the collateral, the LTV ratio is going to be higher, and vice-versa. Higher LTV, meaning that there is a possibility to acquire a bigger loan, also signals that there’s a higher probability of having to liquidate the collateral to cover part or all of the credit. Collateral liquidation is necessary to prevent the loan issuer from experiencing a loss when the value of the loan issued to the client is higher than the value of the collateral.

As cryptocurrencies tend to be volatile, the Loan-to-Value ratio fluctuates as well. If the price of your cryptocurrencies goes up, your LTV goes down. If the value of your cryptocurrencies drops, the LTV does the opposite and rises.

Once the LTV reaches a certain threshold, typically between 70-80%, crypto-backed loans platforms may issue a warning asking the borrowers to either repay a part of the loan or increase the collateral.

How to calculate LTV?

To calculate the LTV ratio of their loan, borrowers have to apply a simple LTV formula: divide the loan value by the collateral value and multiply the ratio by 100%.

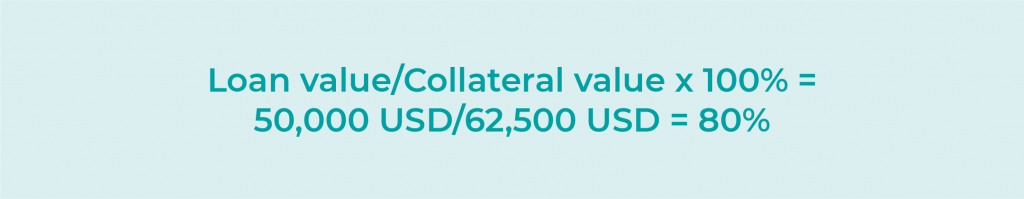

For example, if a borrower has a 100,000 USD worth of Bitcoin and decides to take a 50,000 USD fiat loan, the LTV ratio of the loan would be calculated as follows:

However, what if the price of your collateral currency drops? How to calculate LTV in such a scenario?

Let’s say your collateral is now worth only 62,500 USD. LTV in such case can be calculated with the following LTV formula:

As the LTV reaches a dangerous 80%, a warning will be issued. The borrower now should either repay a part of the loan or increase the collateral to improve the LTV ratio.

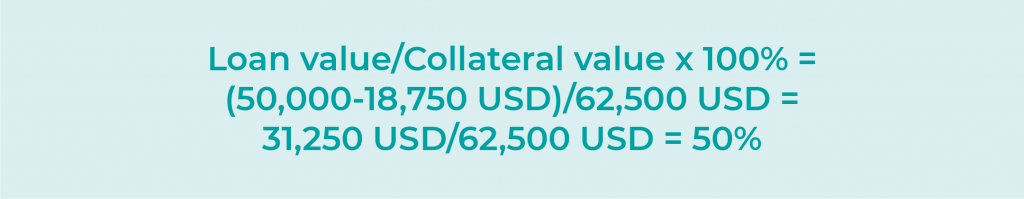

Now, we will showcase another LTV formula that you would use if a part of the loan (in this scenario, 18,750 USD) is repaid:

However, if the borrower does not react to the LTV warning and the LTV ratio increases even more, at 90-95%, the lending platform would usually liquidate the collateral to cover the possible loss.

How to maintain Loan-to-Value on a healthy level?

To maintain loan-to-value at a healthy level and avoid the collateral liquidation scenario, we would suggest the borrowers follow a couple of simple guidelines.

Firstly, choose your collateral currency wisely. As cryptocurrencies tend to experience price fluctuations, it is very important to evaluate the risk of your collateral currency (liquidity, volatility, expected value change).

Secondly, be sure to react to the warning. If the value of your collateral falls significantly enough for a warning to be issued, you should receive a notification from your loan provider.

To minimize the possibility of the LTV falling further, you should either increase the collateral or repay a part of the loan. This way, the LTV can be decreased and the risk of liquidation is minimized.

What is a good LTV ratio?

When you apply for a loan, it is crucial to comprehend the financial implications of a the loan-to-value ratio. However, remember that what is a good LTV ratio, largely depends on the type of loan, interest rates, agreed down payment value, and other variables. At the end of the day, there’s no right answer to what is the optimum LTV. For the most part, you, the consumer, will have to make the decision with respect to LTV, meaning that you’ll need to assess your own capabilities.

To make the loan application process more comfortable and to meet different needs of Bankera Loans clients, we have recently introduced loan packages to our service. Available in three different options — Lowest rates (25% LTV), Most popular (50% LTV), Max LTV (75% LTV) — the loan packages were designed to suit the needs of all level crypto holders.

Currently, our Max LTV option offers one of the highest LTV rates on the market. While choosing a high LTV is a more risky option, it allows the clients to get the biggest available loan with their crypto collateral.

Sign up to Bankera Loans and apply for your crypto-backed loan today!